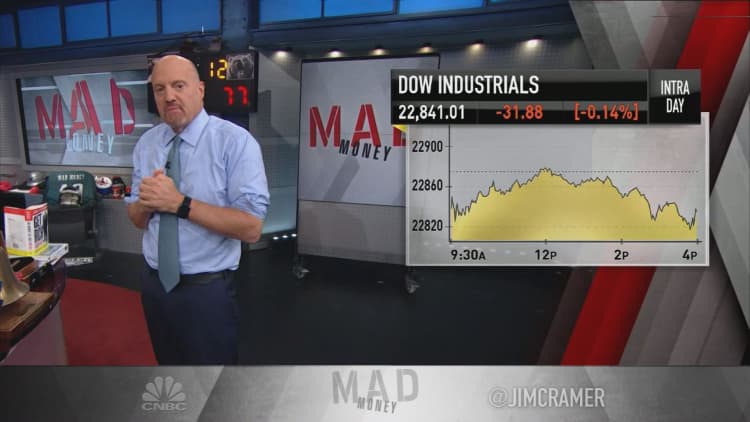

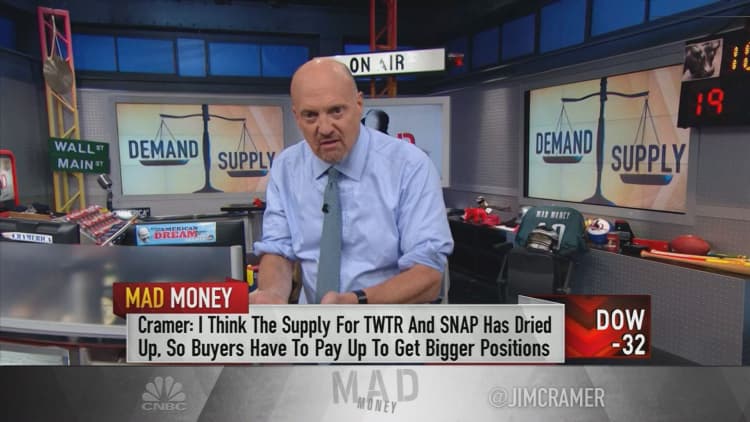

It's easy to forget that stocks can trade, and trade viciously, on the trends of supply and demand, CNBC's Jim Cramer said on Thursday.

"Like any other market, when there's too much demand, stocks go higher, and when there's too much supply ... stocks go lower," the "Mad Money" host said. "Today, you could see those supply and demand dynamics in action ... and that led to some very difficult trading."

When it comes to demand, the technology sector is a clear leader, Cramer said. Investors are hungry for everything from semiconductor and gaming stocks to those tied to e-commerce, social media and software.

Cramer added that the transportation stocks, including airlines, freight forwarders and rails, are also in demand.

Supply is still rife in the struggling retail sector, in which companies are slashing prices to avoid being crushed by high-volume online retailers like Amazon.

Oil stocks are also lagging on a surplus of inventory as energy companies continue to sell oil futures at $50 despite the International Energy Agency's bearish outlook for the fate of oil.

Bank stocks are also creating a "glut of supply" in the market due to a tepid response to earnings from Citigroup and JPMorgan, Cramer said. While the reports beat analyst estimates, both stocks endured losses on concerns over credit costs and lower trading revenues.

Micron was Cramer's top example for tech stocks that drove Thursday's demand. A $1.2 billion stock offering from the semiconductor giant brought so many buyers that shares priced at $41 instead of $40, even floating above $41 for most of Thursday before being dragged down.

"It's incredible that it hung in above $41 for so long despite a declining session. Yes, there's that much demand for semiconductor stocks that when a big chunk comes up for sale, the big institutions couldn't get enough of it," Cramer said. "Plus, Micron's spending the money wisely. They're using $476 million to pay down debt, then using the rest to buy new equipment so they can build more DRAMs and flash chips."

Cramer said this was important because if all of Micron's money went to decreasing its debt, investors would worry about lower demand. If it all went to new equipment, they would worry about oversupply.

"Instead, we got this happy medium and it's stirring interest in the whole industry, including Cramer-fave semiconductor equipment makers Lam Research and Applied Materials," the "Mad Money" host said. "They'll both probably get orders from Micron."

Similarly, buyers are paying premiums for rail, freight and airline stocks as the airlines hint at price increases and the rails see stronger delivery trends, Cramer said.

The market's supply is most clearly embodied by retailers like J.Jill, a newly public apparel company that cut its fiscal third-quarter earnings outlook on Thursday.

"The company had been viewed as a survivor doing better than the other stores in the mall. Instead, we can only conclude that the mall traffic took one more leg down in the month of September," Cramer said. "So, of course, that's another reason to buy the stock of Amazon."

As for the financials, Cramer suggested investors wait until all of the big banks report and the sellers realize that consumers are poised to get more credit than before.

"Don't forget that this market is fickle. Sure, oil and retail have been a continual disappointment, but supply does come out in tech and transports," Cramer said. "As for the banks? They've run a huge amount. It looks like they're now going to give you a chance to scale into them at a lower level. ... My advice: never buy on day one of a big sell-off or day two, either, which would be [Friday]. There will most definitely be more supply behind it."

WATCH: Cramer tracks the stock market's push and pull

Disclosure: Cramer's charitable trust owns shares of Citigroup.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com